Get This Report on The Wallace Insurance Agency

Table of ContentsWhat Does The Wallace Insurance Agency Mean?The Wallace Insurance Agency Can Be Fun For EveryoneThe Main Principles Of The Wallace Insurance Agency The Wallace Insurance Agency - An OverviewHow The Wallace Insurance Agency can Save You Time, Stress, and Money.

You get free preventive care, like injections, testings, and some examinations, even prior to you satisfy your deductible. If you have a Market plan or other qualifying health protection through the plan year 2018, you don't have to pay the fine that people without protection must pay.There is no refuting that you will certainly have higher satisfaction if you recognize that you and your enjoyed ones are financially safe and secure from various unforeseen circumstances. Unpredictabilities in life could turn up at any type of moment, such as an unfortunate fatality or a medical emergency situation. These situations additionally consist of a crash or damage to your vehicle, home, etc.

You might need to dip right into your cost savings or your family members's hard-earned money. Thus, there is a pressing demand of insurance policy for you and your household for correct coverage and monetary support against all threats connected to your life, health and property. Insurance coverage plans are beneficial to any person looking to secure their family, assets/property and themselves from monetary risk/losses: Insurance plans will certainly assist you pay for clinical emergencies, hospitalisation, tightening of any type of ailments and therapy, and treatment needed in the future.

The Definitive Guide for The Wallace Insurance Agency

The family members can likewise pay back any debts like home finances or various other financial obligations which the person insured might have incurred in his/her lifetime Insurance strategies will certainly help your family maintain their requirement of living in case you are not about in the future (Liability insurance). This will help them cover the prices of running the home via the insurance policy lump sum payment

They will make certain that your youngsters are economically safeguarded while pursuing their dreams and passions with no compromises, also when you are not around Numerous insurance policy plans include financial savings and financial investment systems in addition to regular protection. These aid in building wealth/savings for the future with routine investments. You pay premiums regularly and a section of the very same goes towards life protection while the other section goes towards either a cost savings strategy or investment plan, whichever you select based upon your future objectives and requires Insurance assists shield your home in the occasion of any kind of unexpected catastrophe or damages.

If you have coverage for belongings and things inside your home, then you can buy substitute things with the insurance policy money One of the most essential benefits of life insurance policy is that it allows you to save and grow your money. You can use this quantity to fulfill your lasting objectives, like acquiring a house, beginning an endeavor, saving for your child's education and learning or wedding event, and even more Life insurance can allow you to stay financially independent also throughout your retired life.

Excitement About The Wallace Insurance Agency

They are low-risk plans that assist you keep your current lifestyle, fulfill clinical expenses and meet your post-retirement objectives Life insurance policy aids you plan for the future, while assisting you conserve tax * in the present. The premiums paid under the plan are permitted as tax obligation * deductions of as much as 1.

You can conserve approximately 46,800/- in tax obligations * annually. Better, the amounts gotten under the policy are additionally exempt * subject to problems under Section 10(10D) of the Income Tax Obligation Act, 1961. COMP/DOC/Jan/ 2023/41/1904 There are a number of sorts of insurance coverage strategies available. Several of the frequently preferred ones consist of the following: Life insurance is what you can make use in order to protect your household in case of your death during the tone of the plan.

Life insurance coverage assists secure your family members financially with a lump sum quantity that is paid in the event of the policy holder's fatality within the plan duration This is purchased for covering clinical expenditures focusing on various health problems, consisting of hospitalisation, therapies and more. These insurance coverage plans come in helpful in situation of medical emergencies; you can likewise make use of cashless facility across network health centers of the insurance provider COMP/DOC/Sep/ 2019/99/2691.

The Definitive Guide to The Wallace Insurance Agency

When you buy insurance, you'll receive an insurance coverage, which is a lawful contract in between you and your insurance coverage carrier. And when you experience a loss that's covered by your policy and file a case, insurance pays you or a marked recipient, called a beneficiary, based upon the terms of your plan.

Suffering a loss without insurance policy can put you in a difficult monetary circumstance. Insurance policy is an important economic device.

The The Wallace Insurance Agency Ideas

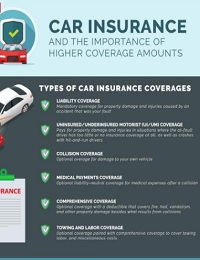

For auto insurance policy, it could imply you have added cash money in hand to help spend for fixings or a replacement lorry after a mishap - https://moz.com/community/q/user/wallaceagency1. Insurance can aid keep your life on course, as a lot as possible, after something negative derails it. Your independent insurance representative is an excellent source for more information about the advantages of insurance coverage, in addition to the benefits in your certain insurance coverage

And sometimes, like vehicle insurance coverage and employees' payment, you may be needed by legislation to have insurance coverage in order to secure others. Discover our, advice Insurance alternatives Insurance coverage is essentially a big nest egg shared by lots of people (called policyholders) and taken care of by an insurance coverage carrier. The insurance business uses money accumulated (called costs) from its insurance policy holders and various other investments to spend for its operations and to satisfy its assurance to insurance policy holders when they submit a claim.